Cross-Chain Interoperability: LayerZero

By

Aditya Saraf, Kelvin Koh

Jun 30, 2024

Over the past few years, the cryptocurrency landscape has evolved significantly, with several Layer 1 and Layer 2 blockchains emerging. However, it remains uncertain whether a single dominant player will prevail. It is likely that multiple blockchains will coexist. General purpose chains benefit greatly from network effects once activity is bootstrapped and will probably attract the majority of user share, as can be seen already in the Ethereum and Solana ecosystems. This multiplicity, while beneficial in keeping transaction fees low across chains by way of high competition, fragments user experience and asset management. To address this issue, bridges were developed to connect different chains, facilitating the movement of liquidity from one chain to another. However, creating secure bridges has proven to be a challenging task in decentralized applications (dApps). In 2022, Chainalysis reported that out of the $3.1 billion stolen from DeFi protocols, 64% resulted from exploits targeting bridging protocols. Interoperability protocols such as LayerZero were introduced to address the shortcomings of cross chain bridges.

LayerZero is a pioneering trust minimized omnichain interoperability protocol that enables direct, cross-chain message passing without the need for intermediaries. This protocol preserves the core principle of censorship resistance and permissionless access, ensuring secure and efficient communication between blockchain networks. LayerZero simplifies cross-chain interactions by deploying a lightweight on-chain client called the LayerZero Endpoint. This client, supported by all 70 chains integrated by LayerZero, creates a fully connected environment where each node has a direct link to every other node. This setup facilitates seamless cross-chain transactions, allowing liquidity to move freely across blockchains. There are over 200 applications built on top of the LayerZero protocol that have facilitated $50B worth of assets being transferred across chains.

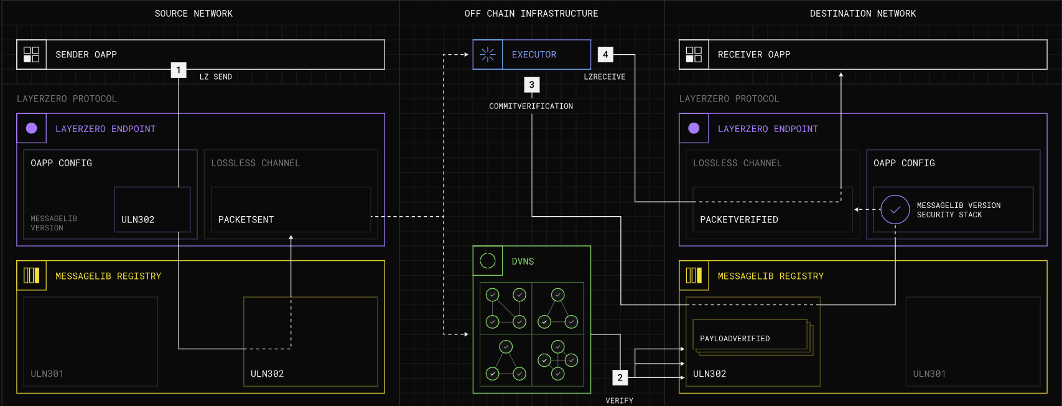

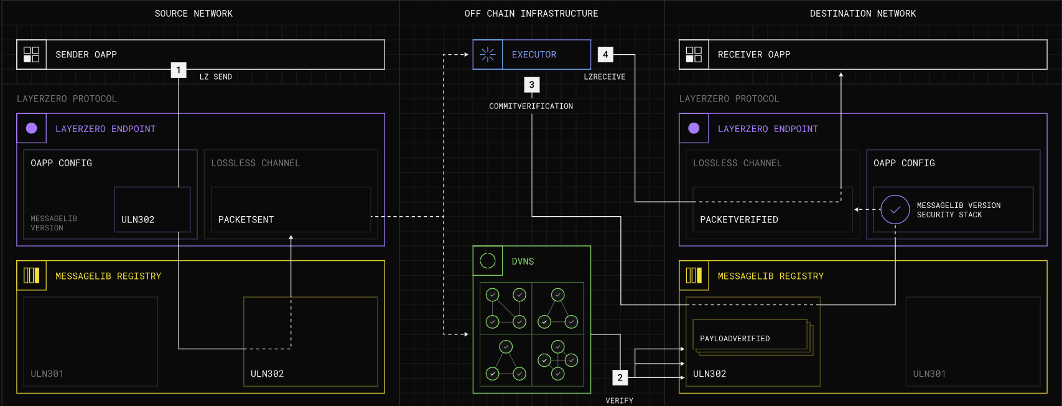

The LayerZero protocol is built around the concept of Trustless Valid Delivery, ensuring that a message is delivered to the receiver only if the associated transaction is valid and committed on the sender chain. This mechanism eliminates the need for users to place trust in intermediaries. LayerZero's architecture consists of three main components: Endpoint Contracts, Decentralized Verifier Networks (DVNs), and Executors.

Endpoint Contracts: These act as entry points for cross-chain messages, managing the sending and receiving of messages across different blockchains.

DVNs: These networks validate the integrity and security of cross-chain message delivery. They ensure that each message is verified by a combination of decentralized entities before execution.

Executors: Responsible for processing and executing the actions specified in cross-chain messages, Executors carry out the final operations on the destination chain after all security verifications are complete.

LayerZero Transaction Lifecycle

Source: LayerZero

The protocol operates through a series of steps involving message initiation, security and verification, and message execution, ensuring trustless and efficient cross-chain communication.

Since inception, many products have been built on LayerZero, including borrow/lend dApps, cross-chain identity dApps, bridges, NFT marketplaces, enterprise projects, NFT projects, meme tokens, and data products. Not surprisingly, LayerZero's capabilities have attracted a range of applications across the DeFi sector. Some notable examples include:

Cross-chain Decentralized Exchanges (DEXs): LayerZero facilitates the creation of cross-chain DEXs that operate exclusively with native assets, allowing seamless asset transfers between chains without relying on wrapped tokens or intermediary sidechains. Stargate is the leading cross-chain DEX built on LayerZero.

Multi-chain Yield Aggregators: Traditional yield aggregators are limited to single-chain ecosystems. LayerZero enables multi-chain yield aggregators to tap into yield opportunities across various ecosystems, expanding access to high-yield opportunities and leveraging market inefficiencies.

Multi-chain Lending: LayerZero simplifies multi-chain lending by allowing users to keep their assets on one chain while lending them out and borrowing directly on another chain, eliminating the need for costly intermediaries and complex processes.

In addition to these applications, LayerZero has enabled the development of Omnichain Fungible Tokens (OFTs), which can move across blockchains seamlessly. Projects like Angle Protocol's agEUR, Ethena's USDe, and ISKRA's gaming tokens leverage the OFT standard for cross-chain operations.

LayerZero’s growing ecosystem

Source: LayerZero

Today, LayerZero is the leading interoperability protocol, but it is not without competition. Wormhole and Axelar are two notable competitors in the space. LayerZero currently leads the market with a 35% market share and facilitates $684 million in monthly cross-chain volume. Wormhole follows closely with a 33% market share and $650 million in volume, while Axelar holds an 18% share, facilitating $353 million monthly.

Wormhole was founded by Jump Crypto, the building arm of Jump Trading Group. Initially launched in 2021, the protocol first debuted as a token bridge, allowing the transfer of tokens between blockchains, most notably between Solana and Ethereum. Wormhole later evolved, with Wormhole V2, to take on a more general approach, turning into an interoperability protocol. Wormhole operates similarly to LayerZero, with the main difference being that the role of the DVN is instead fulfilled by a set of 17 guardian nodes – highly reputable and vetted validators that must confirm each cross-chain transaction. It also boasts handling over 1 billion cross-chain messages and can interoperate with the Cosmos and Polkadot ecosystems. After being exploited for $321 million in 2022, Wormhole has improved its security measures and remains a widely adopted protocol, second only to LayerZero in terms of cross-chain volumes.

Axelar, on the other hand, employs a Proof-of-Stake (PoS) mechanism with a decentralized network of 75 validators. This approach ensures high decentralization and security, reducing dependency on a few entities. Axelar’s hub-and-spoke model enhances network efficiency by minimizing cross-chain connections and simplifying monitoring processes. Additionally, Axelar’s Virtual Machine (AVM) simplifies cross-chain development tasks, providing powerful tools for developers. Axelar stands out for its programmability and flexibility, allowing for seamless integration of new chains without requiring permission. Axelar also introduces the General Message Passing (GMP)protocol. GMP surpasses traditional bridges by enabling applications to send and receive any type of payload across chains, including function calls, data, and wrapped assets. This capability allows applications to offer a seamless one-click user experience across different blockchains. GMP securely synchronizes state between chains, facilitating complex interactions of functions distributed across multiple chains.

On June 20, 2024, LayerZero launched its token, distributing a significant portion to its community and builders. To ensure fairness and mitigate Sybil attacks—where individuals create multiple fake accounts to claim more tokens—LayerZero implemented a robust anti-Sybil strategy. This strategy included a bounty hunter program and a self-reporting system. The self-reporting system promised reporters 15% of their intended token allocation, while those who did not report received no tokens. This approach helped LayerZero effectively counteract Sybil attackers and ensure a fair distribution of tokens to genuine users, thereby maintaining the integrity of the airdrop. The token airdrop was well received by crypto natives and the comprehensive sybil resistant airdrop strategy serves as a good example for future token launches to follow. The ZRO token is trading at a fully diluted valuation of $2.78 billion as of June 30, 2024. Wormhole and Axelar launched their governance tokens (W and AXL respectively) ahead of LayerZero’s token launch. As of June 30, 2024, their fully diluted market cap are $3.36 billion and $658 million respectively.

LayerZero and other interoperability protocols marks a significant step forward in cross-chain interoperability, addressing a major blockchain challenge by enabling direct, trustless transactions across multiple networks. Its innovative design and broad application potential position it as a key player in the DeFi landscape. As these protocols continue to evolve, their commitment to decentralization and security will be crucial. By facilitating seamless cross-chain interactions, interoperability protocols enhance user experience, increases liquidity efficiency, and opens up new possibilities for decentralized applications, contributing to the growth and maturation of the blockchain ecosystem.

Over the past few years, the cryptocurrency landscape has evolved significantly, with several Layer 1 and Layer 2 blockchains emerging. However, it remains uncertain whether a single dominant player will prevail. It is likely that multiple blockchains will coexist. General purpose chains benefit greatly from network effects once activity is bootstrapped and will probably attract the majority of user share, as can be seen already in the Ethereum and Solana ecosystems. This multiplicity, while beneficial in keeping transaction fees low across chains by way of high competition, fragments user experience and asset management. To address this issue, bridges were developed to connect different chains, facilitating the movement of liquidity from one chain to another. However, creating secure bridges has proven to be a challenging task in decentralized applications (dApps). In 2022, Chainalysis reported that out of the $3.1 billion stolen from DeFi protocols, 64% resulted from exploits targeting bridging protocols. Interoperability protocols such as LayerZero were introduced to address the shortcomings of cross chain bridges.

LayerZero is a pioneering trust minimized omnichain interoperability protocol that enables direct, cross-chain message passing without the need for intermediaries. This protocol preserves the core principle of censorship resistance and permissionless access, ensuring secure and efficient communication between blockchain networks. LayerZero simplifies cross-chain interactions by deploying a lightweight on-chain client called the LayerZero Endpoint. This client, supported by all 70 chains integrated by LayerZero, creates a fully connected environment where each node has a direct link to every other node. This setup facilitates seamless cross-chain transactions, allowing liquidity to move freely across blockchains. There are over 200 applications built on top of the LayerZero protocol that have facilitated $50B worth of assets being transferred across chains.

The LayerZero protocol is built around the concept of Trustless Valid Delivery, ensuring that a message is delivered to the receiver only if the associated transaction is valid and committed on the sender chain. This mechanism eliminates the need for users to place trust in intermediaries. LayerZero's architecture consists of three main components: Endpoint Contracts, Decentralized Verifier Networks (DVNs), and Executors.

Endpoint Contracts: These act as entry points for cross-chain messages, managing the sending and receiving of messages across different blockchains.

DVNs: These networks validate the integrity and security of cross-chain message delivery. They ensure that each message is verified by a combination of decentralized entities before execution.

Executors: Responsible for processing and executing the actions specified in cross-chain messages, Executors carry out the final operations on the destination chain after all security verifications are complete.

LayerZero Transaction Lifecycle

Source: LayerZero

The protocol operates through a series of steps involving message initiation, security and verification, and message execution, ensuring trustless and efficient cross-chain communication.

Since inception, many products have been built on LayerZero, including borrow/lend dApps, cross-chain identity dApps, bridges, NFT marketplaces, enterprise projects, NFT projects, meme tokens, and data products. Not surprisingly, LayerZero's capabilities have attracted a range of applications across the DeFi sector. Some notable examples include:

Cross-chain Decentralized Exchanges (DEXs): LayerZero facilitates the creation of cross-chain DEXs that operate exclusively with native assets, allowing seamless asset transfers between chains without relying on wrapped tokens or intermediary sidechains. Stargate is the leading cross-chain DEX built on LayerZero.

Multi-chain Yield Aggregators: Traditional yield aggregators are limited to single-chain ecosystems. LayerZero enables multi-chain yield aggregators to tap into yield opportunities across various ecosystems, expanding access to high-yield opportunities and leveraging market inefficiencies.

Multi-chain Lending: LayerZero simplifies multi-chain lending by allowing users to keep their assets on one chain while lending them out and borrowing directly on another chain, eliminating the need for costly intermediaries and complex processes.

In addition to these applications, LayerZero has enabled the development of Omnichain Fungible Tokens (OFTs), which can move across blockchains seamlessly. Projects like Angle Protocol's agEUR, Ethena's USDe, and ISKRA's gaming tokens leverage the OFT standard for cross-chain operations.

LayerZero’s growing ecosystem

Source: LayerZero

Today, LayerZero is the leading interoperability protocol, but it is not without competition. Wormhole and Axelar are two notable competitors in the space. LayerZero currently leads the market with a 35% market share and facilitates $684 million in monthly cross-chain volume. Wormhole follows closely with a 33% market share and $650 million in volume, while Axelar holds an 18% share, facilitating $353 million monthly.

Wormhole was founded by Jump Crypto, the building arm of Jump Trading Group. Initially launched in 2021, the protocol first debuted as a token bridge, allowing the transfer of tokens between blockchains, most notably between Solana and Ethereum. Wormhole later evolved, with Wormhole V2, to take on a more general approach, turning into an interoperability protocol. Wormhole operates similarly to LayerZero, with the main difference being that the role of the DVN is instead fulfilled by a set of 17 guardian nodes – highly reputable and vetted validators that must confirm each cross-chain transaction. It also boasts handling over 1 billion cross-chain messages and can interoperate with the Cosmos and Polkadot ecosystems. After being exploited for $321 million in 2022, Wormhole has improved its security measures and remains a widely adopted protocol, second only to LayerZero in terms of cross-chain volumes.

Axelar, on the other hand, employs a Proof-of-Stake (PoS) mechanism with a decentralized network of 75 validators. This approach ensures high decentralization and security, reducing dependency on a few entities. Axelar’s hub-and-spoke model enhances network efficiency by minimizing cross-chain connections and simplifying monitoring processes. Additionally, Axelar’s Virtual Machine (AVM) simplifies cross-chain development tasks, providing powerful tools for developers. Axelar stands out for its programmability and flexibility, allowing for seamless integration of new chains without requiring permission. Axelar also introduces the General Message Passing (GMP)protocol. GMP surpasses traditional bridges by enabling applications to send and receive any type of payload across chains, including function calls, data, and wrapped assets. This capability allows applications to offer a seamless one-click user experience across different blockchains. GMP securely synchronizes state between chains, facilitating complex interactions of functions distributed across multiple chains.

On June 20, 2024, LayerZero launched its token, distributing a significant portion to its community and builders. To ensure fairness and mitigate Sybil attacks—where individuals create multiple fake accounts to claim more tokens—LayerZero implemented a robust anti-Sybil strategy. This strategy included a bounty hunter program and a self-reporting system. The self-reporting system promised reporters 15% of their intended token allocation, while those who did not report received no tokens. This approach helped LayerZero effectively counteract Sybil attackers and ensure a fair distribution of tokens to genuine users, thereby maintaining the integrity of the airdrop. The token airdrop was well received by crypto natives and the comprehensive sybil resistant airdrop strategy serves as a good example for future token launches to follow. The ZRO token is trading at a fully diluted valuation of $2.78 billion as of June 30, 2024. Wormhole and Axelar launched their governance tokens (W and AXL respectively) ahead of LayerZero’s token launch. As of June 30, 2024, their fully diluted market cap are $3.36 billion and $658 million respectively.

LayerZero and other interoperability protocols marks a significant step forward in cross-chain interoperability, addressing a major blockchain challenge by enabling direct, trustless transactions across multiple networks. Its innovative design and broad application potential position it as a key player in the DeFi landscape. As these protocols continue to evolve, their commitment to decentralization and security will be crucial. By facilitating seamless cross-chain interactions, interoperability protocols enhance user experience, increases liquidity efficiency, and opens up new possibilities for decentralized applications, contributing to the growth and maturation of the blockchain ecosystem.

To learn more about investment opportunities with Spartan Capital, please contact ir@spartangroup.io