Republican Victory Ushers in a New Era for Crypto

By

Kelvin Koh

Dec 19, 2024

The 2024 US presidential election was one of the most closely watched election in recent years. Most people had expected the election to be a tight race even leading up to the day of the election. However, the outcome of the election took many by surprise. Not only did Trump win the Presidential election in convincing fashion, the Republican party also won the Senate and the House. Such a sweeping victory will give the Republicans the leverage to enact many changes in the years to come. Crypto is one area where we expect sweeping changes are coming and we believe the next 12 months will be bullish for crypto assets.

What was different about the 2024 election is the fact that there was a crypto agenda and the winning President and his closest advisors are crypto friendly. Crypto firms largely supported Trump and key Republican candidates with donations. It is not surprising then that crypto should be one of the major beneficiaries of the resounding Republican victory.

Much has been said about what the implications of this event is for crypto but let me highlight the major ones here:

Under Gensler, the SEC and other Biden administration appointees aggressively policed the crypto industry. Despite repeated calls by the industry to provide regulatory guidance, the SEC steadfastly refused to do so and chose to regulate by enforcement actions instead. During his tenure, Gensler led significant regulatory initiatives, resulting in over 2,700 enforcement actions and $21 billion in penalties. This has made it challenging for many projects to operate out of the US. Trump had said openly that if he wins the election, he will replace Gensler. Not surprisingly, last week Gensler announced that he will be stepping down as SEC chair on 20 January 2025. A number of candidates have been put forward all of whom are viewed as being more crypto friendly. This means existing enforcement actions will be dropped and a new and hopefully more collaborative approach will be taken by the SEC going forward;

One of the challenges faced by the crypto industry in the past was that it was difficult getting anything through the US congress as the majority of the congressman either did not understand crypto or they were outright anti-crypto. Post the election, roughly 2/3 of the congress is composed of pro-crypto congressman. This will likely lead to a pro-innovation regulatory framework, which will make it easier for projects to raise capital going forward and will also allow institutional capital to come into the space more easily;

During his election campaign, Trump had said to his crypto supporters that if elected, he will push for the creation of a strategic Bitcoin reserve, instead of letting the US government dispose of the remaining Bitcoins that they had previously confiscated. This proposal has gathered momentum post the elections. If the proposal materializes, the market will start to speculate if this means the US will become net buyers of Bitcoin instead of sellers. If MicroStrategy alone can impact the price of Bitcoin, imagine what it means for the US government to have a strategic Bitcoin reserve. More importantly, how might other countries react to this development? Will they also start to put forward similar proposals?

Even prior to the election, a team backed by Trump had launched World Liberty Financial in September 2024, aiming to provide decentralized borrowing and lending services, with governance managed through the native WLF token. The project has raised over $50 million so far with the latest investment coming from crypto entrepreneur Justin Sun who invested $30 million earlier this week. WLF plans to raise a total of $300 million. Think about what that means for DeFi to have an initiative like that being endorsed by an incoming US President. Whether they raise $300 million or $50 million matters less than what WLF means for DeFi builders and innovation.

Each of the above events in and of themself are big enough drivers to move crypto markets meaningfully. The combination of them have sweeping implications for the crypto industry that the market hasn't even begun to price in. That is why the US media is heralding this as the Golden Era for Crypto.

In addition to all of the above, Trump has said that he wants the US to become the crypto capital of the world. In a way, the US is already the de-facto crypto leader as many of the major infrastructure projects and some of the biggest blockchain infrastructure companies and decentralised applications originate from the US. It also has the biggest licensed crypto exchange, the biggest crypto investment bank and the largest pool of Web3 VC capital. The US is also home to about 40% of the global BTC mining capacity (vs 17% in 2021) making it the biggest hub for BTC mining, thanks to China. Most of the world's crypto trading is also USD denominated and the major stablecoins are all USD pegged. So, in many ways, the US is already the crypto capital of the world but if the US govt intents to cement or further extend its dominant position, what does it mean for other governments, especially other major financial centres such as London, Tokyo, Dubai and Hong Kong? Importantly also, can Europe afford to miss the Web3 innovation era after losing out in Web2?

Some may question whether Trump will follow through with the above initiatives. I would argue more likely than not. Trump does not follow the conventional rulebook and the leverage they have from the election victory is sizable. In addition, with Elon Musk and JD Vance, Trump has 2 close advisors who are both crypto native. Newly appointed commerce secretary Howard Lutnick is also the chairman and CEO of Cantor Fitzgerald which just acquired a 5% stake in Tether, issuer of the largest stablecoin USDT. Coupled with a more crypto friendly congress, pushing through these initiatives should not be a tall order.

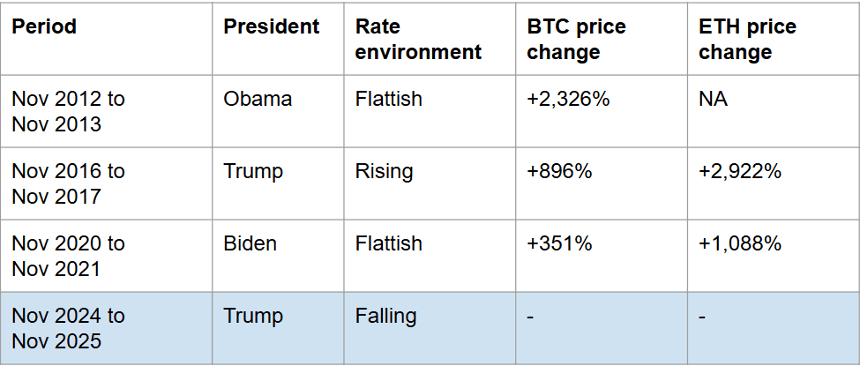

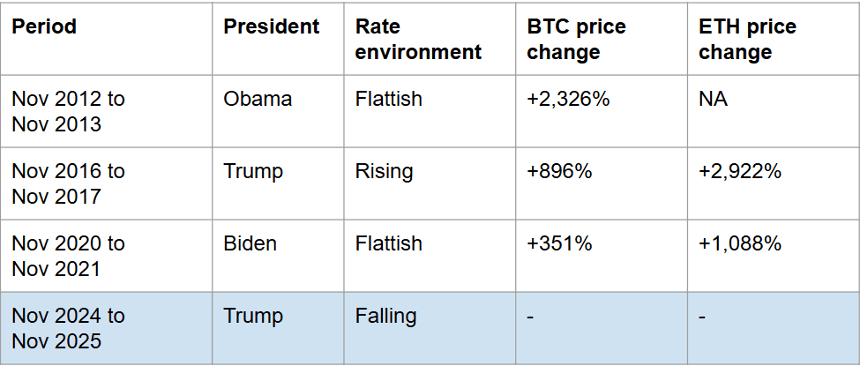

With the above as the backdrop, let’s discuss what all of this means for crypto asset prices. As can be seen from the table below, historically, the 12-month period following the US elections has been a strong period for crypto prices.

There are 2 major observations here:

Regardless of who won the Presidency and what the interest rate environment was, crypto assets did well in the 12-month period post the US election. We attribute this to 2 factors:

a) Clarity from the election outcome and optimism about a new government, and

b) Continued tailwind from the BTC halving/crypto cycle

In the last 2 post-election periods, altcoins (proxied by ETH) returned about 3X of BTC's returns.

So far, in the 30 days since the 2024 election, BTC is up 46% while ETH is up 58% and we believe there is significantly more upside in the coming 11 months.

Crypto assets have performed well during the 12 months post every U.S. election cycle

Source: Spartan Capital Research

To better understand the altcoin opportunity, let’s look at the chart below which shows the performance of altcoins against Bitcoin. You can see that over the cycle there are periods when altcoins sharply outperformed Bitcoin. We call these periods the “altcoin cycle” or “altcoin season”. The last major altcoin cycle took place in January 2021 and peaked in November 2021. The one before that occurred started in February 2017 and peaked in January 2018. It is worth noting that these altcoin cycles broadly overlap with the 12-month post-election period. We believe the main reason for this is the strong price performance in the initial weeks post-election and investor sentiment turns risk on. In addition, it also starts to attract retail capital into the asset class, and retail capital tends to prefer riskier small and mid-cap tokens and they don’t have the liquidity constraints that institutional investors have. Also, up until this point in the cycle, altcoins tend to underperform and that makes their risk reward more attractive vs the large caps. This has also been the case in this cycle. If this historical relationship holds, then we should expect altcoin season to start imminently. This is the sweet spot for our fund strategy and why we are very bullish about the outlook in the next 12 months.

Altcoins significantly outperforms BTC during altcoin season

Source: Spartan Capital Research

The 2024 US presidential election was one of the most closely watched election in recent years. Most people had expected the election to be a tight race even leading up to the day of the election. However, the outcome of the election took many by surprise. Not only did Trump win the Presidential election in convincing fashion, the Republican party also won the Senate and the House. Such a sweeping victory will give the Republicans the leverage to enact many changes in the years to come. Crypto is one area where we expect sweeping changes are coming and we believe the next 12 months will be bullish for crypto assets.

What was different about the 2024 election is the fact that there was a crypto agenda and the winning President and his closest advisors are crypto friendly. Crypto firms largely supported Trump and key Republican candidates with donations. It is not surprising then that crypto should be one of the major beneficiaries of the resounding Republican victory.

Much has been said about what the implications of this event is for crypto but let me highlight the major ones here:

Under Gensler, the SEC and other Biden administration appointees aggressively policed the crypto industry. Despite repeated calls by the industry to provide regulatory guidance, the SEC steadfastly refused to do so and chose to regulate by enforcement actions instead. During his tenure, Gensler led significant regulatory initiatives, resulting in over 2,700 enforcement actions and $21 billion in penalties. This has made it challenging for many projects to operate out of the US. Trump had said openly that if he wins the election, he will replace Gensler. Not surprisingly, last week Gensler announced that he will be stepping down as SEC chair on 20 January 2025. A number of candidates have been put forward all of whom are viewed as being more crypto friendly. This means existing enforcement actions will be dropped and a new and hopefully more collaborative approach will be taken by the SEC going forward;

One of the challenges faced by the crypto industry in the past was that it was difficult getting anything through the US congress as the majority of the congressman either did not understand crypto or they were outright anti-crypto. Post the election, roughly 2/3 of the congress is composed of pro-crypto congressman. This will likely lead to a pro-innovation regulatory framework, which will make it easier for projects to raise capital going forward and will also allow institutional capital to come into the space more easily;

During his election campaign, Trump had said to his crypto supporters that if elected, he will push for the creation of a strategic Bitcoin reserve, instead of letting the US government dispose of the remaining Bitcoins that they had previously confiscated. This proposal has gathered momentum post the elections. If the proposal materializes, the market will start to speculate if this means the US will become net buyers of Bitcoin instead of sellers. If MicroStrategy alone can impact the price of Bitcoin, imagine what it means for the US government to have a strategic Bitcoin reserve. More importantly, how might other countries react to this development? Will they also start to put forward similar proposals?

Even prior to the election, a team backed by Trump had launched World Liberty Financial in September 2024, aiming to provide decentralized borrowing and lending services, with governance managed through the native WLF token. The project has raised over $50 million so far with the latest investment coming from crypto entrepreneur Justin Sun who invested $30 million earlier this week. WLF plans to raise a total of $300 million. Think about what that means for DeFi to have an initiative like that being endorsed by an incoming US President. Whether they raise $300 million or $50 million matters less than what WLF means for DeFi builders and innovation.

Each of the above events in and of themself are big enough drivers to move crypto markets meaningfully. The combination of them have sweeping implications for the crypto industry that the market hasn't even begun to price in. That is why the US media is heralding this as the Golden Era for Crypto.

In addition to all of the above, Trump has said that he wants the US to become the crypto capital of the world. In a way, the US is already the de-facto crypto leader as many of the major infrastructure projects and some of the biggest blockchain infrastructure companies and decentralised applications originate from the US. It also has the biggest licensed crypto exchange, the biggest crypto investment bank and the largest pool of Web3 VC capital. The US is also home to about 40% of the global BTC mining capacity (vs 17% in 2021) making it the biggest hub for BTC mining, thanks to China. Most of the world's crypto trading is also USD denominated and the major stablecoins are all USD pegged. So, in many ways, the US is already the crypto capital of the world but if the US govt intents to cement or further extend its dominant position, what does it mean for other governments, especially other major financial centres such as London, Tokyo, Dubai and Hong Kong? Importantly also, can Europe afford to miss the Web3 innovation era after losing out in Web2?

Some may question whether Trump will follow through with the above initiatives. I would argue more likely than not. Trump does not follow the conventional rulebook and the leverage they have from the election victory is sizable. In addition, with Elon Musk and JD Vance, Trump has 2 close advisors who are both crypto native. Newly appointed commerce secretary Howard Lutnick is also the chairman and CEO of Cantor Fitzgerald which just acquired a 5% stake in Tether, issuer of the largest stablecoin USDT. Coupled with a more crypto friendly congress, pushing through these initiatives should not be a tall order.

With the above as the backdrop, let’s discuss what all of this means for crypto asset prices. As can be seen from the table below, historically, the 12-month period following the US elections has been a strong period for crypto prices.

There are 2 major observations here:

Regardless of who won the Presidency and what the interest rate environment was, crypto assets did well in the 12-month period post the US election. We attribute this to 2 factors:

a) Clarity from the election outcome and optimism about a new government, and

b) Continued tailwind from the BTC halving/crypto cycle

In the last 2 post-election periods, altcoins (proxied by ETH) returned about 3X of BTC's returns.

So far, in the 30 days since the 2024 election, BTC is up 46% while ETH is up 58% and we believe there is significantly more upside in the coming 11 months.

Crypto assets have performed well during the 12 months post every U.S. election cycle

Source: Spartan Capital Research

To better understand the altcoin opportunity, let’s look at the chart below which shows the performance of altcoins against Bitcoin. You can see that over the cycle there are periods when altcoins sharply outperformed Bitcoin. We call these periods the “altcoin cycle” or “altcoin season”. The last major altcoin cycle took place in January 2021 and peaked in November 2021. The one before that occurred started in February 2017 and peaked in January 2018. It is worth noting that these altcoin cycles broadly overlap with the 12-month post-election period. We believe the main reason for this is the strong price performance in the initial weeks post-election and investor sentiment turns risk on. In addition, it also starts to attract retail capital into the asset class, and retail capital tends to prefer riskier small and mid-cap tokens and they don’t have the liquidity constraints that institutional investors have. Also, up until this point in the cycle, altcoins tend to underperform and that makes their risk reward more attractive vs the large caps. This has also been the case in this cycle. If this historical relationship holds, then we should expect altcoin season to start imminently. This is the sweet spot for our fund strategy and why we are very bullish about the outlook in the next 12 months.

Altcoins significantly outperforms BTC during altcoin season

Source: Spartan Capital Research

To learn more about investment opportunities with Spartan Capital, please contact ir@spartangroup.io